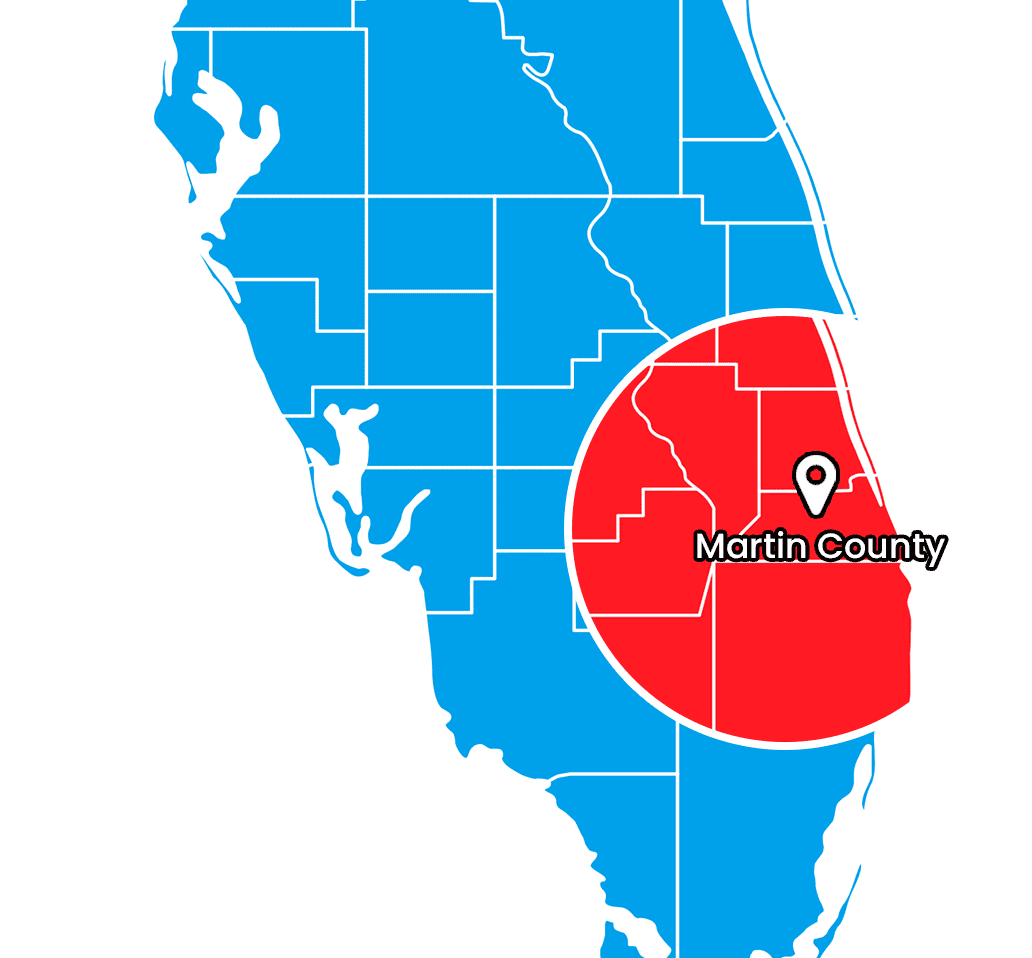

Things You Need to Know About Filing a Water Damage Insurance Claim in Port St. Lucie

March 20, 2023

Insurance is one of those necessary evils. It’s nice to have the safety net to pay for water damage when it occurs, but filing a claim isn’t without its challenges. Some insurance companies make the process incredibly difficult, and many homeowners lack experience because emergencies don’t happen often.

As a result, some homeowners may not get the coverage they need to fully restore their homes. In worst cases, the

water damage insurance claim may be denied altogether. This can cost a homeowner thousands of dollars out of pocket just to make their Port St. Lucie home safe again!

Fortunately, there are a few ways that homeowners can ensure they get adequate coverage for their loss. Keep reading to learn more about filing a water damage insurance claim.

The Source of Water Needs to be Eliminated Right Away

First and foremost, the source of the water damage needs to be addressed. Insurance companies want to see that action is taken to mitigate the damage, so the homeowner should identify the source of water flow and stop it, if possible.

For stormwater damage, they may have to do temporary construction. Tarps and boards can help keep the rain out until the house can be safely restored. If the water damage was caused by a plumbing issue like a leaking toilet or burst pipe, the homeowner should shut off the water supply closest to the damage. If that isn’t possible, the main water supply line should be shut off until help arrives.

All Information Must Be Documented

A homeowner can never record too much information when they are dealing with water damage. Not only do they need to have basic information like a timeline and description of the damage, but they also need to document all of the steps they took to mitigate water damage.

That’s not all!

It’s also highly recommended that homeowners keep a record of any communication they have with their insurance company and contractors. Written proof is always best, so email is a great tool during this process. Even if the insurance company calls, the customer should request a follow-up email that details their conversation.

Homeowners should also keep track of any spending that occurs as a result of the water damage. Having receipts can ensure that they get reimbursed for these costs. They should even add any quotes to this folder so that they can provide their insurance company with the most accurate and detailed information.

Photos Are Typically Required by Insurance Companies

It’s not enough to just tell an insurance company that a home was damaged. They are going to want to see photos of everything, including the source of water and anything that was damaged. While it might be tempting to get work cleaning up the property right away, these pictures MUST be taken.

It’s especially important that homeowners do not throw anything away unless the damage has been documented in a photo and listed in the home’s inventory. If it isn’t documented, the insurance company could choose to deny coverage for that particular item. Videos are another great tool that homeowners can use to show how severe the damage is.

A Professional Water Damage Company Can Help

One of the best things that a homeowner can do is let a professional handle their water damage insurance claim. These days, many damage restoration contractors offer insurance claim filing as part of their full-service solutions. That means that homeowners don’t have to stress over being the middleman between their contractor and insurance company.

It also means that the homeowner has a better chance of getting fair coverage. As mentioned previously, many homeowners lack experience with the claims process, so they often miss out on things that the restoration experts wouldn’t.

Restoration companies know the importance of documenting every single item and room that is damaged so they can assist with taking photos to provide to the insurance company. They can also discuss their quote with the insurance company to make sure that the customer gets the best coverage possible.

Ask About How DRYOUTpro PLUS Can Help With a Water Damage Insurance Claim

Filing a water damage insurance claim doesn’t have to be hard.

DRYOUTpro PLUS is here to help homeowners in Port St. Lucie with all of their water damage restoration needs, including filing the claim. Local homeowners can contact this team of reliable professionals 24/7 by calling their emergency number. They can also

submit the online form to request a free quote for their restoration project.

Get A Free Estimate

By filling out the form below