24/7 emergency Damage Restoration services

SERVING THE PAlm BEACHES AND TREASURE COAST OF FLorida

Does Renters Insurance Cover Water Damage? What You Need to Know

June 11, 2024

When water damage strikes your rental home, it can cause a lot of stress and confusion. Understanding the coverage of renters insurance for water damage is important. In this blog, we will explore what renters insurance typically covers regarding water damage, the tenant's rights, how to file a claim, and when to look for professional help. Plus, you must know that some restoration companies can also help you with these issues. If you need a water damage restoration Sturart FL, read on!

Understanding Renters Insurance

Renters insurance is a type of insurance policy designed for people who rent their homes. It provides coverage for personal belongings, liability, and additional living expenses if you are temporarily displaced due to damage to your rental home. Renters insurance policies usually include different types of coverage, such as:

- Personal Property Coverage: Protects your personal items against risks like theft, fire, and certain types of water damage.

- Liability Coverage: Covers you if someone is injured in your rental or if you accidentally damage someone else's property.

- Additional Living Expenses: Helps pay for extra costs if you need to live somewhere else temporarily while your rental home is being repaired.

Does Renters Insurance Cover Water Damage? Types of Water Damage Covered

So, does renters insurance cover water damage? If your head is buzzing from this one and other questions like:

Does renters insurance cover water leak damage? Does renters insurance cover water damage from rain? Does renters insurance cover water damage from toilets? Does renters insurance cover water damage from burst pipes? Here are some answers:

- Water Leak Damage: If a sudden and accidental water leak damages your belongings, renters insurance typically covers this. For example, if a pipe bursts and soaks your furniture, your policy should help pay for replacements.

- Water Damage from Rain:

If rainwater enters your rental home due to a sudden issue like a broken window or roof damage, the damage to your personal property may be covered. However, if the rain damage results from a maintenance issue the landlord neglected, coverage may vary.

- Water Damage from Toilet: If a toilet overflows accidentally and causes water damage, your renters insurance will likely cover the damage to your belongings.

- Water Damage from Burst Pipe: Burst pipes causing water damage are usually covered under renters insurance, especially if the burst was sudden and accidental.

However, it's important to understand that renters insurance policies also have limits and exclusions. For instance, damage due to flooding or negligence might not be covered unless you have specific additional coverage.

Additional Coverage Options

Sometimes, standard renters insurance might not cover all types of water damage. Additional coverage options include:

- Flood Insurance: Covers damage from natural flooding, which is typically not included in standard renters insurance policies.

- Additional Water Damage Coverage: Offers extra protection for specific water damage scenarios not covered by your standard policy.

Tenant Rights and Responsibilities

Understanding tenant rights and responsibilities is important when dealing with water damage. As a tenant, you have the right to live in a habitable home. This means the landlord must keep the property in good condition and fix any issues that could lead to water damage. However, you also have responsibilities, such as reporting problems on time and taking reasonable steps to prevent further damage.

If water damage occurs, your renters insurance can help cover your personal property, but you may also be responsible for certain repairs if the damage was caused by your negligence. Always review your lease agreement and insurance policy to understand your obligations and coverage limits.

Filing a Water Damage Claim

If you are not sure if you can file a water damage claim with your renters insurance, know that this can be a straightforward task. You can follow these steps:

- Document the Damage: Take photos and videos of all damaged items and areas.

- Notify Your Landlord:

Inform your landlord about the damage immediately.

- Contact Your Insurance Provider:

Call your insurance company to report the damage and start the claims process.

- Fill Out Necessary Forms:

Complete any required paperwork from your insurance company.

- Provide Evidence:

Submit the documentation of the damage, along with any receipts or proof of ownership for the damaged items.

- Follow-up: Keep in touch with your insurance company to track the progress of your claim.

When to Seek Professional Help for Water Damage in Your Rental

Besides being aware of your tenant rights, policy coverage, and how to file a claim, knowing when to call professionals is also important. These are scenarios where that is needed:

- Extensive Damage: Large-scale or structural issues require expertise. Professionals have the knowledge and equipment to assess the damage accurately and implement effective restoration measures.

- Contaminated Water: Clean water from burst pipes may be relatively safe to handle, but contaminated water from sewage backups or flooding requires specialized cleanup procedures.

- Mold Growth:

If you notice mold growth or a musty odor, enlist the help of professionals who can safely remove the mold and prevent its recurrence.

- Electrical Hazards:

If you suspect water has come into contact with electrical outlets, appliances, or wiring, refrain from repairing it yourself and contact a qualified professional immediately.

- Persistent Problems: If issues persist, professionals can identify and tackle root causes effectively.

Contact DRYOUTpro PLUS, INC. for Professional Help

If you experience water damage, professional help is just a call away. DRYOUTpro PLUS, INC. offers expert water damage restoration services in Stuart, FL, and can also assist with handling insurance claims to ensure you get the support you need. Reach us by phone at (772) 288-4222 or submit an online form on our website.

Get A Free Estimate

By filling out the form below

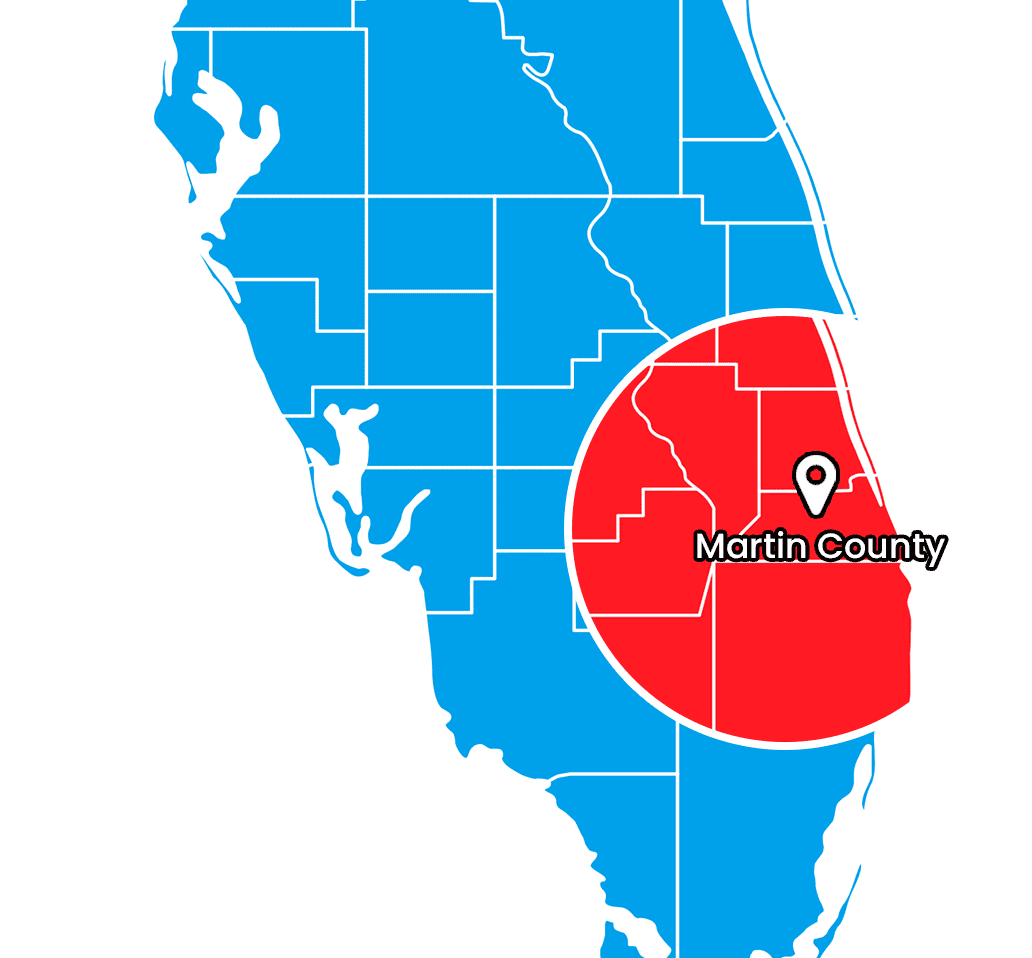

Our Service Area in Martin County Florida

As a local, family-owned company, we are committed to keeping your family safe from any problems you may have. We provide a full line of restoration services to all in the following areas:

Stuart, Palm City, Jensen Beach, Hobe Sound, Jupiter, Tequesta, Palm Beach Gardens, North Palm Beach, Port St. Lucie, Ft. Pierce, Palm Beach, West Palm Beach, Ft. Pierce, St. Lucie County

Need Help With Disaster Restoration?

GET A FREE QUOTE TODAY

We are IICRC certified and hire only the most trustworthy and dedicated team members to ensure that each job is taken seriously and handled with absolute professionalism.