24/7 emergency Damage Restoration services

SERVING THE PAlm BEACHES AND TREASURE COAST OF FLorida

Does Renters Insurance Cover Fire Damage? Everything You Need to Know

July 23, 2024

Renters insurance is an essential safeguard for anyone living in a rented property. It protects against different risks, including theft, water damage, and especially fire. Fire incidents can be devastating, causing significant damage and loss. In such situations, knowing that your insurance can help you recover is very important. We will answer the question: ‘Does renters insurance cover fire damage?’ In addition, we’ll explore what renters insurance typically includes, how it handles fire damage, and what steps to take if you ever find yourself in such an unfortunate event. We'll discuss the importance of fire damage restoration Stuart or in any other location and how these services play a role in recovering from fire damage.

What is Renters Insurance?

Renters insurance is a type of insurance policy designed to protect individuals renting a home or apartment. The renters insurance usually does not cover structural damages since they are typically covered by landlord insurance. In addition, certain types of flooding and earthquakes may require separate policies. The following should be covered by your renter’s insurance policy:

- Personal Belongings: Renters insurance covers your personal belongings in case of theft, fire, or certain types of water damage.

- Liability Protection: This covers you if someone is injured in your home or if you accidentally cause damage to someone else's property.

- Additional Living Expenses: If your home is damaged and you need to live elsewhere temporarily, this part of the policy can cover the additional costs.

Does Renters Insurance Cover Fire Damage?

The short answer is yes, renters insurance does cover fire damage. Renters insurance fire coverage applies to various scenarios. For instance, if you accidentally start a fire in your apartment, your renter's insurance will cover the damage to your personal belongings. Similarly, if a fire starts elsewhere and spreads to your apartment, causing damage to your possessions, your policy will cover those losses. Electrical fires caused by issues within your apartment are also typically covered by renters insurance. However, it is very important to review your specific policy details because coverage limits and exclusions can vary.

Specifics of Apartment Fire Insurance Coverage

Apartment fire insurance coverage under renters insurance primarily protects your personal property. It does not cover the building itself, which is the landlord’s responsibility. Many renters believe their landlord’s insurance covers their personal belongings. This is not the case; the landlord’s policy covers the structure, while your renter's insurance covers your possessions. Always review your policy details to understand the extent of your apartment fire insurance coverage. Look for any exclusions or limits that might apply.

What to Do After a Fire: Steps for Renters

Experiencing a fire can be overwhelming, but taking the right steps immediately after can help you recover quickly. Here's what you should do:

Ensure Safety

First and foremost, make sure you and your family are safe. Evacuate the building as quickly and calmly as possible, and call emergency services to report the fire. Safety should always be your top priority. Even after the fire is extinguished, avoid re-entering the building until it has been declared safe by the authorities. There may be structural damage or lingering hazards like smoke and hot spots.

Contact Your Insurance Provider

Once everyone is safe, notify your insurance company as soon as possible to start the claims process. Contacting your insurer promptly is important because they will guide you through the next steps and help you understand what is covered under your policy. Provide them with all necessary information and follow their instructions closely.

Document the Damage

To support your insurance claim, document the damage thoroughly. Take clear, detailed photos of all affected areas and damaged items. Make a list of everything that has been damaged or destroyed, including descriptions, approximate values, and any receipts or proof of purchase you might have. This documentation will be essential for your insurance adjuster when assessing the extent of the damage and determining the compensation you are entitled to.

Seek Fire Damage Restoration Services

Professional fire damage restoration services can be invaluable in the aftermath of a fire. These experts are trained to handle the cleanup and restoration process safely. They can help with tasks such as removing soot and smoke, cleaning salvageable items, and repairing structural damage.

Secure Temporary Housing

If your home is uninhabitable due to the fire, you may need to find temporary housing. Your renters insurance may cover additional living expenses, which can include the cost of a hotel, meals, and other necessities while your home is being repaired. Check with your insurance provider to understand what is covered and make arrangements accordingly.

How to Make Sure You Have Adequate Fire Coverage

To make sure you have adequate fire coverage under renters insurance, it’s important to regularly evaluate your policy. Start by assessing the value of your belongings and choosing coverage limits that reflect their worth. As you acquire new items or make significant purchases, update your coverage accordingly to avoid being underinsured. Regular policy reviews and updates are important because your insurance needs may change over time.

The Role of Property Insurance

Property insurance covers the building structure and is the responsibility of the landlord. Renters insurance complements property insurance by covering the tenant’s personal belongings and liability. While property insurance and renters insurance serve different purposes, they work together to provide comprehensive protection.

Need Help After a Fire? Contact DRYOUTpro PLUS, INC.

When disaster strikes, quick and professional restoration can make all the difference. If you've experienced fire damage, the team at DRYOUTpro PLUS, INC. is here to help. Our experts provide top-notch fire damage restoration services to get your home back to its best condition. Call us at (772) 288-4222 or fill out an online form on our website.

Get A Free Estimate

By filling out the form below

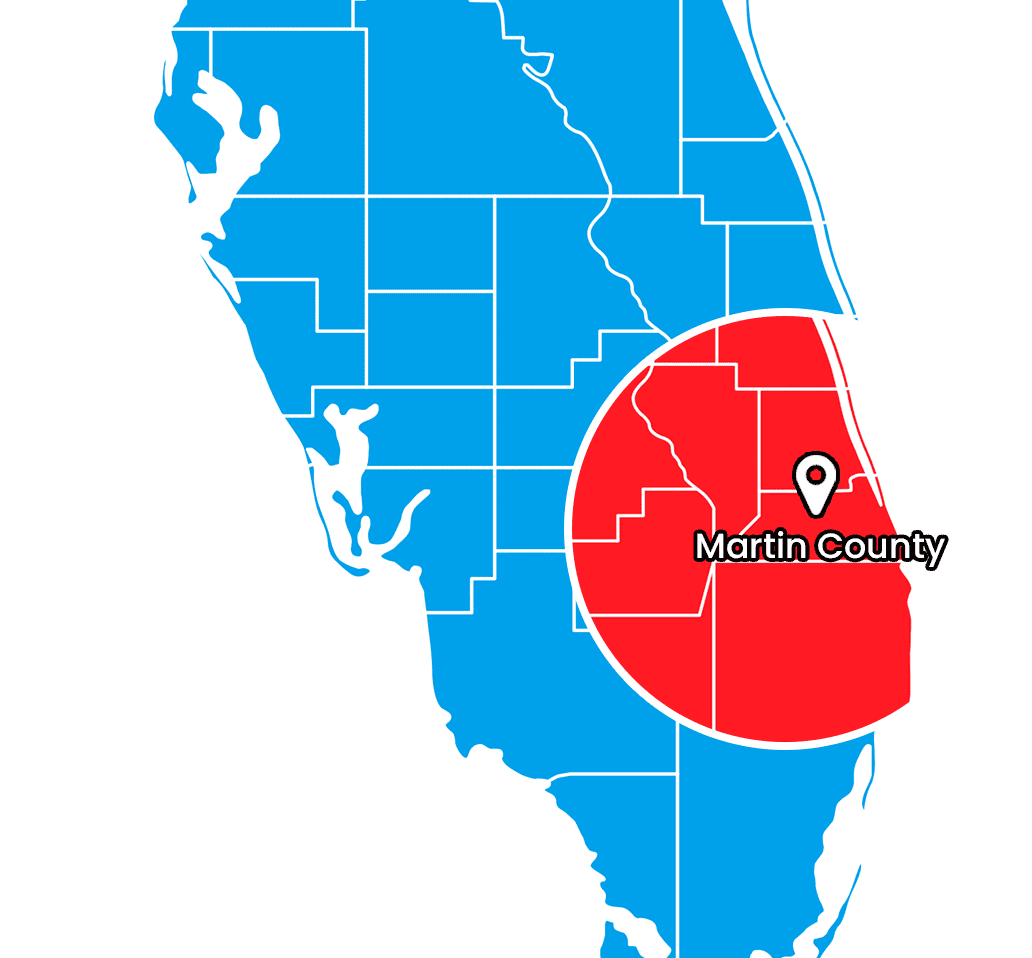

Our Service Area in Martin County Florida

As a local, family-owned company, we are committed to keeping your family safe from any problems you may have. We provide a full line of restoration services to all in the following areas:

Stuart, Palm City, Jensen Beach, Hobe Sound, Jupiter, Tequesta, Palm Beach Gardens, North Palm Beach, Port St. Lucie, Ft. Pierce, Palm Beach, West Palm Beach, Ft. Pierce, St. Lucie County

Need Help With Disaster Restoration?

GET A FREE QUOTE TODAY

We are IICRC certified and hire only the most trustworthy and dedicated team members to ensure that each job is taken seriously and handled with absolute professionalism.