24/7 emergency Damage Restoration services

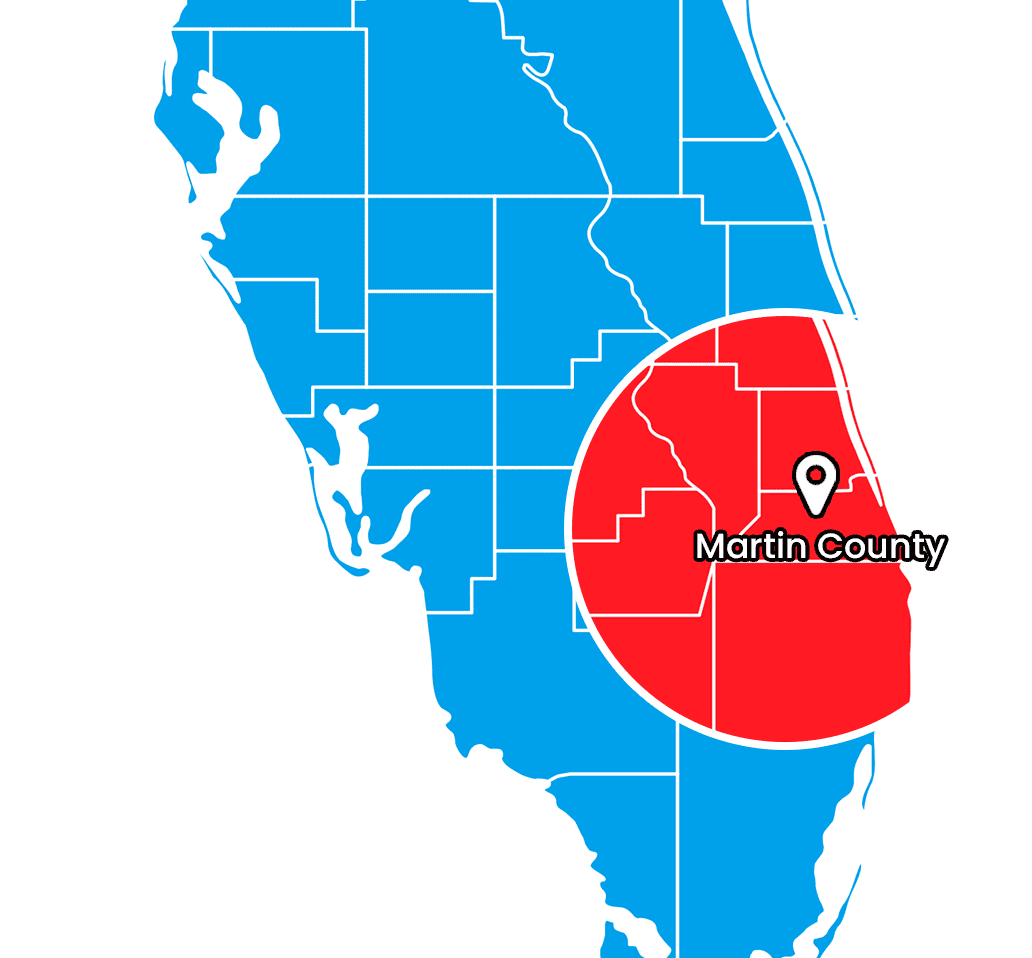

SERVING THE PAlm BEACHES AND TREASURE COAST OF FLorida

Renters Insurance Fire Coverage: A Lifeline in Times of Crisis

July 9, 2024

Imagine coming home to find that a fire has swept through your apartment. Everything you own is damaged or gone. It’s a situation no one wants to face, yet it happens more often than we think. According to the National Fire Protection Association, there are over 100,000 fires in rental properties every year. This is why understanding renters insurance fire coverage is so important. Fire damage restoration in Martin County or other services near you can be very helpful for many renters who have faced the devastating effects of fires. Let's explore how renters insurance can be a lifeline in such times of crisis.

The Importance of Renters Insurance Fire Coverage

Renters insurance is a type of insurance policy that provides coverage for a renter's personal belongings, liabilities, and sometimes additional living expenses in the event of disasters like fires. Specifically, fire coverage under a renters insurance policy protects your personal property from damage or loss due to fire. Having fire coverage is extremely important for renters. Without it, you could face significant financial losses, as the cost of replacing personal belongings can be overwhelming. Renters insurance makes sure that you can recover and rebuild after a fire, providing financial security.

Does Renters Insurance Cover Fire Damage?

So, does renters insurance cover fire damage? Yes, it does. Most standard renters insurance policies include fire damage as a covered peril. This means that if your personal property is damaged or destroyed by a fire, your insurance will help pay to replace or repair your items. For example, if a kitchen fire damages your furniture and electronics, your renter's insurance policy would cover the cost of replacing these items. Similarly, if a fire in your building results in smoke damage to your clothing and other personal items, your policy would typically cover the cleaning or replacement of these items.

Filing a Fire Damage Insurance Claim

Filing a fire damage insurance claim involves several steps:

- Document the Damage: Take photos and make a list of all damaged items.

- Notify Your Insurer: Contact your insurance company as soon as possible to report the fire and start your claim.

- Fill Out Claim Forms: Complete any necessary claim forms provided by your insurer.

- Meet with the Adjuster: An insurance adjuster will inspect the damage and assess the claim.

- Receive Payment: Once the claim is approved, you will receive payment to cover your losses.

Keep detailed records of your belongings, save receipts, and stay in communication with your insurance company to make sure your claim is processed smoothly.

Does Car Insurance Cover Fire Damage?

You might wonder, does car insurance cover fire damage? The answer is yes, but only if you have comprehensive coverage. Comprehensive car insurance covers damage to your vehicle from non-collision incidents, including fire. While both renters insurance and car insurance can cover fire damage, they apply to different types of property. Renters insurance covers personal belongings within your rental unit, whereas comprehensive car insurance covers your vehicle. It’s important to have both types of coverage to fully protect your assets.

Preventative Measures and Safety Tips

Being proactive about fire safety can make a significant difference in preventing fires and minimizing damage. Use these simple safety measures to protect your home and loved ones, and make sure you are prepared in case of an emergency:

Smoke Alarms

Make sure that your rental unit has functioning smoke alarms. Test them regularly and replace batteries as needed. Smoke alarms can provide early warnings and save lives.

Fire Extinguishers

Keep a fire extinguisher in your rental unit, especially in the kitchen where fires are more likely to start. Learn how to use it properly.

Escape Plan

Create and practice a fire escape plan with all members of your household. Know at least two exits from each room and establish a meeting place outside the building.

The Role of Property Insurance

Property insurance is a broader term that includes various types of insurance policies, such as homeowners, renters, and commercial property insurance. These policies provide coverage for property damage and liability. It’s important to understand the specifics of your policy. Property insurance policies vary, and knowing what your policy covers can help you prepare for and respond to emergencies like fires.

Knowing Policy Limits and Exclusions

Be aware of the limits of your renter's insurance policy. These limits dictate the maximum amount your insurer will pay for a covered loss. Make sure your policy limits are sufficient to cover the value of your personal belongings. Understand what is not covered by your renter's insurance policy. For example, damage caused by natural disasters like earthquakes and floods may not be covered and may require additional coverage.

How to Choose the Right Renters Insurance Policy

Evaluate the value of your personal belongings and determine how much coverage you need. Consider factors like the size of your rental unit, the location, and your personal risk factors. Shop around and compare renters insurance policies from different providers. Look at coverage options, policy limits, deductibles, and premiums to find a policy that best fits your needs. Research customer reviews and ratings of insurance companies to find out about their reliability and customer service. Choose a provider with a strong reputation for handling claims efficiently.

Contact DRYOUTpro PLUS, INC. And We Will Help You Solve All Your Fire Damage Issues

Experiencing a fire in your home is a stressful and overwhelming event. At DRYOUTpro PLUS, INC., we understand the urgency and complexity of fire damage restoration. Our team of experienced professionals is here to help you every step of the way. From assessing the damage to restoring your property, we provide successful solutions to get your life back to normal. Call us at (772) 288-4222 or fill out an online form on our website.

Get A Free Estimate

By filling out the form below

Our Service Area in Martin County Florida

As a local, family-owned company, we are committed to keeping your family safe from any problems you may have. We provide a full line of restoration services to all in the following areas:

Stuart, Palm City, Jensen Beach, Hobe Sound, Jupiter, Tequesta, Palm Beach Gardens, North Palm Beach, Port St. Lucie, Ft. Pierce, Palm Beach, West Palm Beach, Ft. Pierce, St. Lucie County

Need Help With Disaster Restoration?

GET A FREE QUOTE TODAY

We are IICRC certified and hire only the most trustworthy and dedicated team members to ensure that each job is taken seriously and handled with absolute professionalism.